4-minute read

Did you know the word “tax” came from the Latin word “taxo” which means “I estimate”?

You might tear your hair out each year every time tax return comes around. Not to fret; we’ve put together a few tips for anyone working as a travel nurse or midwife!

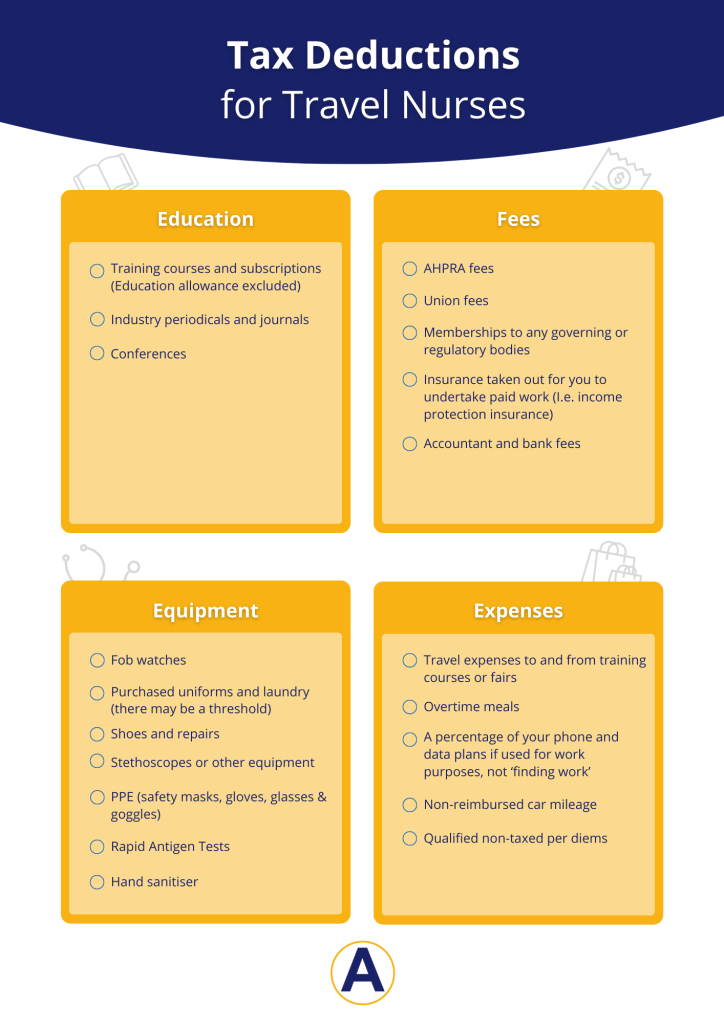

What can you claim on your tax return?

The age-old question comes around every year, “can I claim this on my tax return?”

The rule of thumb is if it’s a cost directly incurred to you and hasn’t been reimbursed, you can claim it. When in doubt, please seek advice from your accountant.

Save the guide below to keep handy for when you need to start preparing your taxes.

What can’t you claim on your tax return?

According to H&R Block, if it’s not related to your job and can be used for other purposes, it won’t be claimable on tax. Examples include:

- Relocation fees

- Fines and penalties

- Driver’s license

- Prescription glasses and contacts

- Grooming (hairdresser, hair & skincare products)

- Things that have already reimbursed to you (stipends, meal allowances)

Our blog Tax as an agency nurse – questions to ask your accountant, also has more tips and tricks to help you navigate tax time.

It all can seem like a lot to keep track of, can’t it? Luckily, record-keeping has come a long way. In fact, the first computers the ATO used in the mid-1960s were mostly for sending around five million refund cheques each year.

What records should you keep for tax time?

With the luxury of smartphones, apps and digital storage, documents are now more convenient to upload, store and download.

Keep in mind the ATO require you to keep all records for the past 7 years. We recommend taking photos of your receipts and documents and uploading them into a central folder. Some smartphones have a native camera function to scan documents and receipts and save them as high-quality images.

If your phone does not have this, below are a few apps to help you capture, convert and store your receipts central and easy to access when July comes around.

To get the most out of your tax return, make sure your receipts can clearly display the following information:

- Name of supplier or merchant

- Amount of expense

- Nature of goods or services

- Date the expense was paid

- Date of the document

Pro-tip: Looking for your End of Year Income Certificate? All figures are now directly uploaded via Single-Touch Payroll (STP) and can be viewed in your MyGov account, in line with ATO requirements.

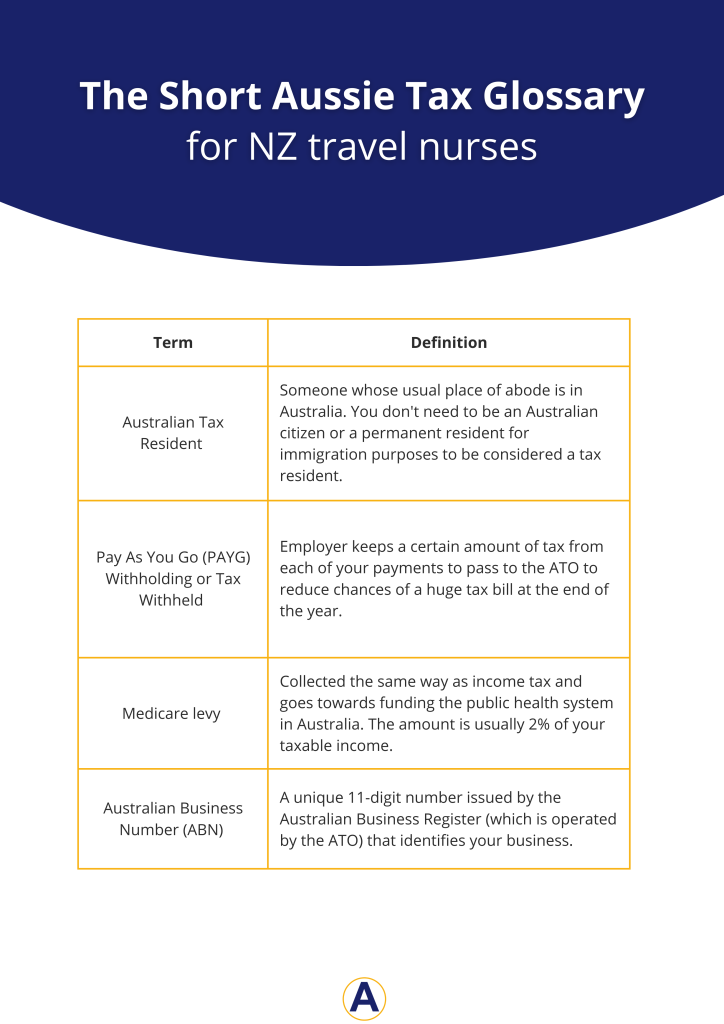

Tax tips if you’re from New Zealand

If you’re from New Zealand trying to grasp the ATO’s process and requirements, the first thing to know is that you may be classified as an Australian Tax Resident during your time in Australia.

Confirm with your tax agent whether this applies to you, to ensure you are correctly benefiting from the lowest tax rates you are eligible for on your return.

When you are lodging, you will be prompted to select your appropriate tax situation. Typically, you would lodge under the salaries and wages section.

Here are some terms below which can be significant when you are lodging your claim, as there can be confusion about which situation best suits your income as a travel nurse! You may come across a few other terms listed within this glossary as well but do not need to use them exclusively for tax returns.

As a reference point, you are not required to lodge under an ABN, company, partnership or trust income. This is because you would not technically be conducting a business for travel nursing or midwifery, nor lodging Business Activity Statements (BAS) taxes every quarter.

Pro-tip: The ATO provides career-specific deduction guides for income, allowances and record-keeping. Read more here.

Have more questions about lodging your taxes as a travel nurse or midwife? Visit the ATO website, or get in touch with your consultant or our payroll team today.